An online post by a 29-year-old government employee about his financial difficulties has drawn the attention of many netizens.

Salary not enough to cover monthly debts

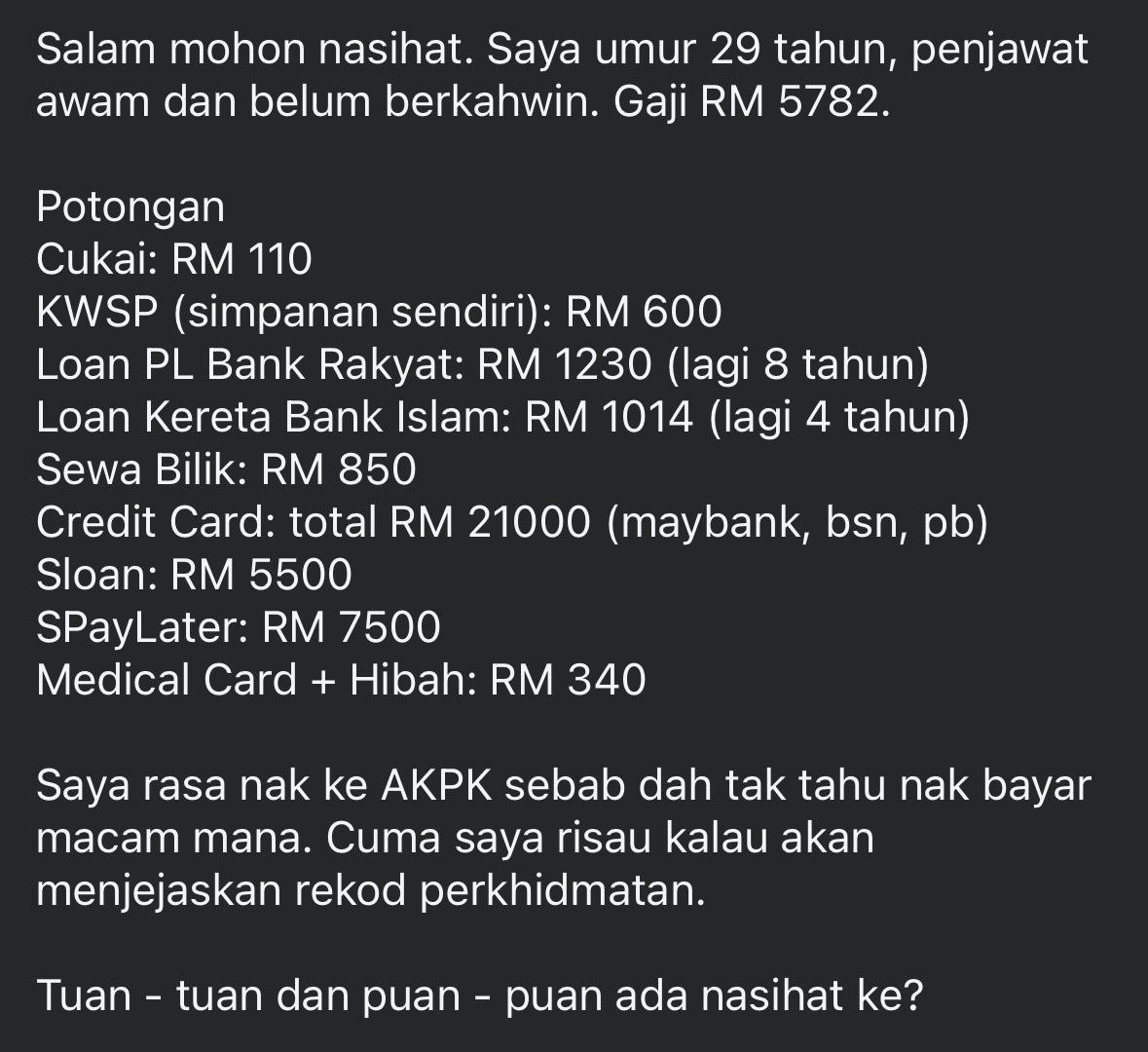

The individual said that he makes RM5,782 per month in an anonymous post that was posted in the Muflis Bankrupt di Malaysia Facebook page.

However, he said that his debts and costs were too much for him to handle any longer.

His monthly payments include RM600 to his EPF (self-contribution), RM1,230 for a personal loan, RM1,014 for his car loan, and RM850 for room rent.

Drowning in credit card and BNPL debt

Besides loans and rent, the man also owes RM21,000 in credit card debt across three banks and RM5,500 in another personal loan.

He also has RM7,500 in Buy Now Pay Later (BNPL) schemes, along with RM340 monthly for a medical card and hibah.

Thinking of getting help from AKPK

He revealed that he is now considering getting help from the Credit Counselling and Debt Management Agency (AKPK), but is afraid that this move might affect his job record as a civil servant.

I’m thinking of approaching AKPK because I no longer know how to manage these payments. But I’m worried it might affect my service record. Do any of you have advice for me?” he asked in the post.

Netizens offer advice and reality checks

His post quickly went viral, with more than 330 comments and 31 shares at the time of writing.

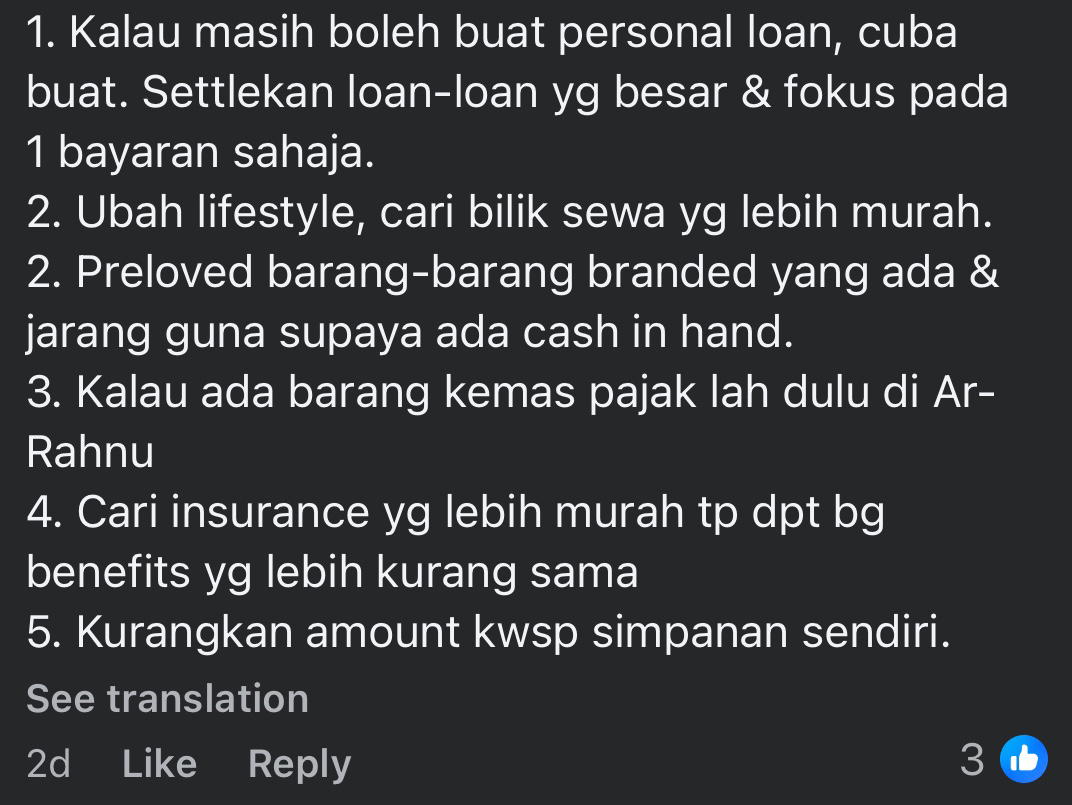

Many netizens stepped in with financial advice, urging him to downgrade his way of living.

‘1. If you can still take a personal loan, try to do it. Use it to settle the big loans and focus on just one monthly payment.

2. Change your lifestyle, find a cheaper room to rent.

3. Sell off branded items that you rarely use so you’ll have more cash on hand.

4. If you have valuable items, pawn them at Ar-Rahnu for quick cash.

5. Look for cheaper insurance that still gives the same benefits.

6. Reduce your voluntary EPF contribution.’

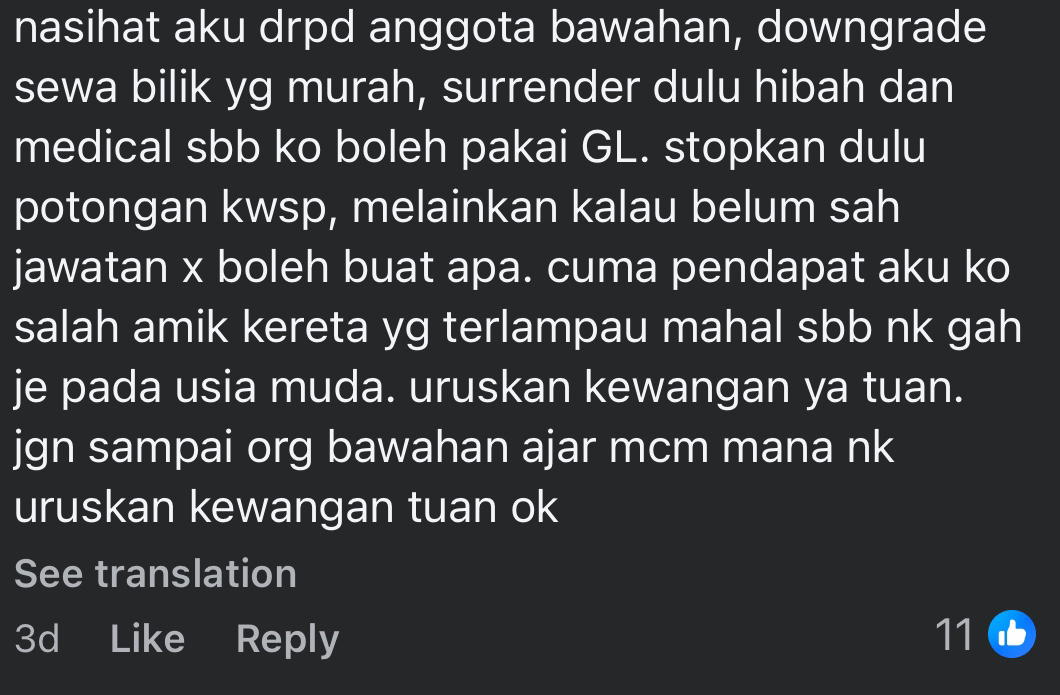

‘My advice from a junior officer: downgrade to a cheaper room, cancel your hibah and medical card for now because you can use the government medical benefit (GL).

Stop your EPF contribution unless your job is not yet permanent—if that’s the case, you can’t do anything. Just my opinion, you made a mistake by getting an expensive car to look flashy at a young age. Please manage your finances, sir. Don’t let the lower-ranked officers end up teaching you how to handle your own money.’

Others also reassured him that consulting with AKPK would not ruin his working reputation.

‘Just go to AKPK. There’s really no problem.’

‘1. Go to AKPK. Restructure your personal loan and credit cards. Monthly installments will be lower but the term will be longer. Your credit cards will be blocked automatically. Your name won’t be eligible for any loans during the AKPK period. After that, things will return to normal.

2. Use the extra money from your salary to clear the smallest debts first.

Increase monthly payments/set targets. Be disciplined and stop using Buy Now Pay Later and loans until everything is cleared. As for EPF savings, if there’s an option, reduce your voluntary contribution a bit.’

What do you think about this? Share your thoughts with us in the comment section.

View the original post HERE.

READ ALSO: